If you would like to support the ongoing work of McNeil Trust, you can make donations.

If you are a UK taxpayer, you can also gift aid any donations you make. Here are some guidelines about Gift Aid.

To make a gift aid donation, you need to be paying UK income tax. Currently, any annual income over £12,750 (£1062.50 per month) is the tax threshold.

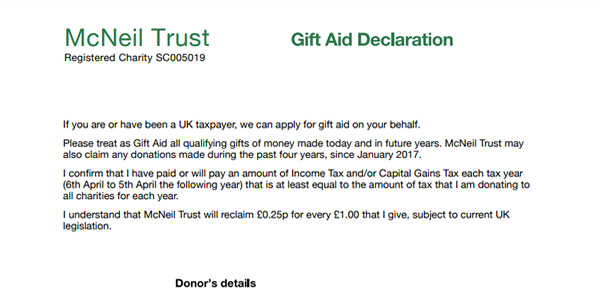

If you wish to make a gift aid donation, you must sign a gift aid declaration form before donating. The form can be downloaded here or there is a hard copy in the apartment, or it can be attached to you in an email.

For Gift Aid donations, we receive a further 25% from HMRC of any gift aid value – so, if you gift aid £100, the charity gets £125.

You are allowed to gift aid to charities four times the amount of tax you pay per year in total. Bear in mind that this is for all gift aided donations you make not just to one charity. So, for instance, if you pay £500 tax a year you can donate up to £2000 in total to charities.

You do not get any tax advantage for making a gift aided donation if you pay tax at the basic rate. If you pay a higher rate of tax than the basic rate, however, your tax threshold will be raised so that your liability to pay tax begins at a higher level.